Virtual Banks and Loans Without an Office — Should We Trust Neo-Banks?

Gone are the days when getting a loan meant dressing up, booking a meeting, and sitting across a polished desk while someone looked at your papers and decided your fate. Today, you can borrow money in your pajamas — without ever speaking to a single human. Welcome to the world of neo-banks, where everything from opening an account to securing a loan happens through an app. No branches. No suits. No lines. Just clicks.

Sounds convenient, right? It is. But here’s the question: is it too easy? Can you really trust a bank that doesn’t have a front door? And more importantly, should you take out a loan from one? Let’s break down how neo-banks actually work, why they’re exploding in popularity, and what to keep in mind before you borrow from a bank that lives entirely on your screen.

What Are Neo-Banks, Exactly?

Neo-banks — also known as digital-only banks — are financial institutions that operate 100% online. No physical branches. No face-to-face service. They offer many of the same things traditional banks do: checking accounts, savings, cards, and yes, loans. But it’s all done through your phone or computer.

Most neo-banks aren’t technically banks in the old-school sense. They often partner with licensed banks to hold deposits or issue loans. What they focus on is user experience — clean design, quick access, no paperwork, and instant decisions. That’s their selling point. And that’s why they’ve been gaining ground fast, especially with younger people who find traditional banking too slow, too rigid, or too out of touch.

Why People Love Them

Let’s be honest — traditional banks haven’t always made things easy. Long waits, outdated apps, complicated forms, and hard-to-reach support make even basic tasks feel like chores. Neo-banks flipped the script by doing the opposite. Their apps are intuitive. Verification is fast. You can apply for a loan in minutes, get approved in seconds, and start spending by the end of the day.

For a lot of people, that speed is a game-changer. Need a short-term loan to cover rent or an unexpected bill? No problem. No appointments, no bank manager, no judgment. Just a few taps and a confirmation code.

Neo-banks also tend to be more transparent about fees — at least on the surface. Many advertise no hidden charges, real-time updates, and simple repayment schedules. That level of clarity is appealing in a financial world where fine print usually hides surprises.

But What’s the Catch?

Here’s the part you need to think twice about. Just because a bank is digital doesn’t mean it’s safer, smarter, or even more affordable. In fact, the convenience can make it easier to fall into financial traps — especially when borrowing money.

Many neo-bank loans are instant, unsecured, and short-term — which sounds great until you miss a payment or realize the interest rate is way higher than expected. The fast onboarding process often skips in-depth credit checks, which means approval is easy but the terms may not be fair. Some users report vague contract language, high late fees, or apps that make it hard to change repayment settings.

Another concern? Customer service. With no physical office, if something goes wrong, your only option is chat or email — and response times vary. If you’re dealing with a dispute, fraud issue, or loan problem, that lack of personal support can feel like a dead end.

So, Can You Trust Them?

The answer depends on the specific neo-bank and how well it’s regulated. Some of the big names are backed by real banks, operate under financial licenses, and follow strict digital security protocols. Others? Not so much. Some are fintech startups with flashy branding but minimal oversight. And in a space moving this fast, not every platform is playing by the same rules.

If you’re considering taking out a loan from a neo-bank, do your homework. Look at whether they’re registered with a financial authority. Read reviews — especially the bad ones. Dig into the loan agreement, not just the marketing banner. Pay close attention to repayment rules, fees, and your right to dispute charges or change terms.

Why They’re Not Going Away

Neo-banks aren’t a trend — they’re part of a much bigger shift. As people get more comfortable managing money online, and as regulators catch up with the tech, digital banking will only grow. For many, especially in places where traditional banking is limited or expensive, these apps are a lifeline. They offer access, speed, and — in the best cases — fairer terms than traditional banks.

In fact, some neo-banks specialize in underserved groups: freelancers, gig workers, people with poor credit, or those without formal employment. They use alternative data (like transaction history or mobile behavior) to assess risk — which can be more inclusive than credit scores alone. That’s a real advantage. But it also raises new questions about privacy and algorithmic bias, especially when decisions are made automatically with little explanation.

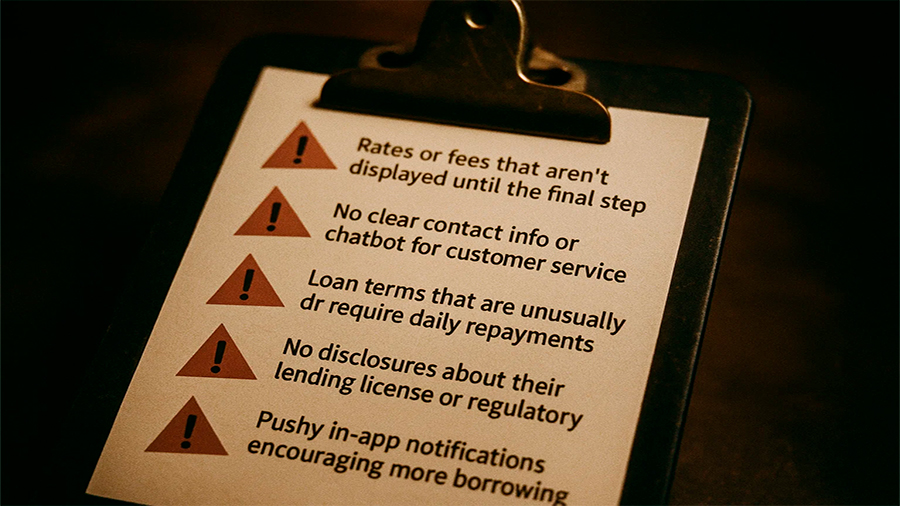

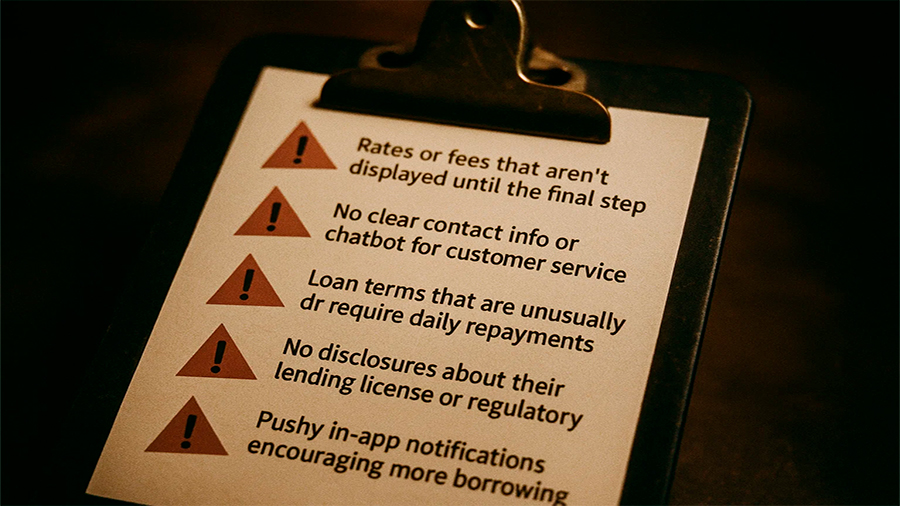

Red Flags to Watch Before Borrowing

If you’re going to borrow from a digital-only lender, keep an eye out for these warning signs:

- Rates or fees that aren’t clearly displayed until the final step

- No clear contact info or only a chatbot for customer service

- Loan terms that are unusually short or require daily repayments

- No disclosures about their lending license or regulatory status

- Pushy in-app notifications encouraging more borrowing

These aren’t always deal-breakers, but they’re signs to pause, read the details, and maybe compare offers with more transparent lenders before committing.

What to Ask Yourself Before You Click “Accept”

Digital lending should be simple — but it still requires thought. Before taking out a loan from a neo-bank, ask yourself:

- Do I actually need this loan, or is it just easy to take?

- Can I repay it on time without missing other bills?

- Would I get better terms from a traditional bank or credit union?

- Is this platform well-reviewed, licensed, and secure?

If you’re answering “I’m not sure” to any of these, take a step back. Convenience is great, but debt is still debt — whether it comes in a paper envelope or a sleek mobile app.

The Conclusion

Neo-banks have changed how we think about banking — and in many ways, that’s a good thing. They’ve made money management faster, more accessible, and less intimidating. But when it comes to loans, the rules haven’t changed: read everything, understand the cost, and never assume that slick design means a better deal. You can borrow money without stepping into a branch — just make sure you’re not walking into a trap instead.